What Is Business Insurance for Small Business

Business insurance for a small business is the set of insurance policies designed to protect the company’s finances when something goes wrong—accidents, lawsuits, property damage, employee injuries, cyber incidents, professional mistakes, natural disasters, or interruptions that stop you from operating.

For most small businesses, insurance is not about “if” you’ll ever use it; it’s about preventing one unexpected event from becoming a business-ending event. Even a single claim can create costs that overwhelm cash flow, especially when legal defense, medical bills, repairs, and lost revenue stack up at the same time.

What makes business insurance confusing is that it isn’t one product. It’s a toolbox. Different industries face different risks, and different policies cover different “types” of losses. A landscaper’s biggest threats are bodily injury and property damage at a jobsite, while a marketing agency’s biggest threat might be a professional services dispute or a cyber issue involving client data. The right insurance plan is really a risk management plan—built to match what you do, what you own, where you operate, how you get paid, and what your customers require.

Why Small Businesses Need Business Insurance

Small businesses typically run lean, which is exactly why they need protection. When a large company gets hit with a lawsuit or a major claim, it can absorb the cost through reserves and diverse revenue streams. A small business usually can’t. One uninsured incident can force you to drain savings, go into debt, or shut down. Insurance exists to transfer that financial risk away from the business and into a predictable monthly or annual cost that you can plan for.

Insurance also helps you win work. Many commercial clients, property managers, general contractors, and government entities will not hire a small business without proof of insurance. It signals credibility and stability, and it reduces their own risk. Even if your business is low-risk, insurance can be the difference between landing larger contracts and staying stuck with smaller projects that don’t pay as well.

How Business Insurance Works

Business insurance works through policies that define what is covered, what is excluded, and how claims are handled. You pay a premium (monthly or annually). If a covered event happens, you file a claim. The insurer investigates and, if the claim is covered, pays for losses up to the policy limits. Most policies also include deductibles—an amount you pay out of pocket before the insurer pays the rest.

Two terms matter a lot: “limits” and “exclusions.” Limits are the maximum the insurer will pay (per claim and often per year). Exclusions are events or situations the policy will not cover. Many small businesses assume they are covered for “anything bad,” but policies are very specific. Understanding what’s inside the policy is critical, because the real value of insurance is how it responds in your worst-case scenario—not how it sounds when you buy it.

The Core Types of Business Insurance Most Small Businesses Use

The backbone of small business insurance typically includes general liability, commercial property, workers’ compensation, and sometimes professional liability or cyber liability depending on the business. Many owners start with a Business Owner’s Policy (BOP), which bundles general liability and commercial property into one policy, often at a better price than buying separately. A BOP is a common starting point for businesses with a physical location or business-owned equipment, but it’s not the only solution.

The key is matching coverage to exposure. If you go on other people’s property, general liability is often essential. If you have inventory, tools, computers, or a building you rely on, property coverage matters. If you have employees, workers’ comp is usually legally required. If you provide advice, creative work, or professional services, professional liability becomes a major consideration.

General Liability Insurance: The “Foundation” Policy

General liability insurance helps cover claims that your business caused bodily injury, property damage, or certain personal/advertising injuries. This is the classic “slip-and-fall” coverage if a customer gets injured at your location, but it also applies to jobsite incidents—for example, if you damage a client’s property while performing a service. It can cover medical costs, repair costs, settlements, and—importantly—legal defense costs.

Many owners underestimate how expensive legal defense alone can be. Even if you did nothing wrong, you may have to pay attorneys to respond to a lawsuit. General liability policies often provide defense, which is one of the biggest benefits. For businesses that interact with customers, work on-site, or operate in public-facing environments, general liability is one of the most common and practical protections.

Professional Liability Insurance: When Your Work Product Is the Risk

Professional liability insurance (often called errors and omissions, or E&O) covers claims that you caused a financial loss due to a mistake, missed deadline, negligence, or failure to deliver professional services as promised. This is especially relevant for consultants, agencies, accountants, bookkeepers, IT providers, designers, and anyone whose main deliverable is expertise or a service outcome rather than physical labor.

A dispute doesn’t have to involve malicious intent to become expensive. A client might claim your work caused them revenue loss, reputational harm, or wasted budget. Professional liability can help cover legal defense and settlements in those scenarios. If you’re in a service business where clients rely on your expertise, this policy often matters as much as general liability—sometimes more.

Commercial Property Insurance: Protecting What You Own to Operate

Commercial property insurance covers physical assets: your building (if you own it), leasehold improvements (if you rent), equipment, tools, computers, furniture, inventory, and sometimes signage. If a fire, theft, vandalism, or certain weather events damage your property, this policy helps pay for repairs or replacement. For many small businesses, the ability to replace equipment quickly is the difference between staying open and losing weeks of revenue.

Property coverage gets tricky in the details. For example, some causes of loss (like flooding) are usually excluded and require separate policies. Also, coverage may be based on replacement cost or actual cash value. Replacement cost generally pays to replace the item new; actual cash value accounts for depreciation and can pay much less than you expect. If you rely on equipment to make money, replacement cost coverage is often the safer structure.

Business Interruption Insurance: Coverage for “Lost Income”

Business interruption insurance (often included in a BOP or purchased as an add-on) helps replace lost income and cover ongoing expenses if your business cannot operate due to a covered event—such as a fire that shuts down your location. This coverage matters because the damage is not only the broken building or equipment; it’s the revenue you can’t earn while you’re closed. Rent, payroll, loan payments, and other bills still show up even when sales stop.

A common misunderstanding is that business interruption covers any drop in sales, but it typically requires a covered property loss that forces suspension of operations. Still, for retail, restaurants, clinics, offices, or any location-based business, it can be the coverage that prevents a temporary shutdown from turning into a permanent one.

Workers’ Compensation Insurance: Often Required When You Have Employees

Workers’ compensation (workers’ comp) covers medical expenses and lost wages when employees are injured or become ill due to work. In most states, it is required once you have employees, even if the business is small. It also protects employers by limiting lawsuits related to workplace injuries in many situations. If you have a team doing physical work—construction, maintenance, deliveries, manufacturing—workers’ comp is non-negotiable.

Even for businesses with office staff, injuries happen: slips, falls, repetitive stress, and carpal tunnel claims are real. If you misclassify workers or try to “go without” coverage when it’s required, penalties can be severe. The right approach is to understand your state’s rules, classify workers correctly, and treat workers’ comp as a baseline cost of operating.

Commercial Auto Insurance: When Vehicles Are Part of the Business

If your business owns vehicles, commercial auto insurance covers them. It can cover liability and physical damage, much like personal auto insurance, but structured for business use. This matters because personal auto policies often exclude coverage when a vehicle is used primarily for business purposes. If you have a work truck, a delivery van, or employees driving company vehicles, commercial auto is usually essential.

Even if you don’t own vehicles, you may need hired and non-owned auto coverage. That covers liability if employees use their own cars for business errands or if you rent vehicles for work. Many small businesses discover this gap only after an accident creates a claim that their personal policy refuses to handle in a business context.

Cyber Liability Insurance: A Modern Risk for “Non-Tech” Businesses Too

Cyber liability insurance helps when your business experiences a data breach, ransomware attack, phishing loss, or exposure of sensitive information. Even small local businesses can be targets because attackers often go after easy opportunities, not only giant corporations. If you store customer contact info, accept digital payments, use cloud services, or rely on email for invoices, you have cyber exposure.

Cyber coverage can help pay for forensic investigations, customer notifications, credit monitoring services, legal defense, ransomware negotiation, and recovery costs. It can also cover business interruption caused by cyber events. For businesses increasingly dependent on digital systems, cyber insurance has shifted from “nice to have” to “serious consideration.”

Employment Practices Liability Insurance: Claims From Within the Team

Employment practices liability insurance (EPLI) covers claims related to employment issues like wrongful termination, discrimination, harassment, and retaliation. This type of claim can occur even in small businesses with a handful of employees. EPLI can help cover legal defense and settlements, which can be financially crushing even if the employer believes they acted appropriately.

As you hire and grow, your risk profile changes. Policies like EPLI become more relevant, especially if you’re building a team, managing performance, and dealing with the complex human realities of employment. Insurance doesn’t replace good HR practices, but it can keep one employment dispute from derailing the entire business.

Product Liability Insurance: When You Sell Physical Products

Product liability insurance covers claims that a product you sold caused injury or property damage. This can apply whether you manufacture, distribute, or even re-sell products under certain circumstances. If someone claims your product was defective or lacked adequate warnings, the costs can escalate quickly due to medical bills and legal action.

If you sell food, cosmetics, supplements, children’s items, or anything that touches the body, product liability becomes even more important. Even with careful quality control, claims can happen. For e-commerce businesses, product liability is often one of the top policies to evaluate, especially as sales volume increases.

Umbrella Insurance: Extra Protection Over Your Limits

Umbrella insurance provides additional liability limits above your underlying policies, like general liability and commercial auto. If you have a serious claim that exceeds your base policy limits, umbrella coverage can be what protects your business assets and keeps you from paying out-of-pocket beyond your standard policy’s cap.

This is particularly relevant if you operate in higher-risk environments, have a lot of foot traffic, work on expensive property, or do projects where the potential damage could be large. Umbrella coverage is often relatively cost-effective compared to raising limits on multiple individual policies, but it depends on your risk profile and insurer requirements.

What Business Insurance Does Not Cover

Insurance is powerful, but it’s not a blank check. Many policies exclude intentional acts, fraudulent behavior, and certain types of contractual disputes. Property policies often exclude flood damage and may restrict certain wind or earthquake events depending on location. General liability doesn’t cover your own professional mistakes—that’s what E&O is for. Cyber events may be excluded from standard policies without a cyber endorsement or separate cyber policy.

A major “gotcha” is assuming a policy covers something it doesn’t. For example, a business may assume general liability covers damage to their own tools—it usually doesn’t. Or they assume property insurance covers lost revenue during a shutdown—it may not unless business interruption is included. Reading the declarations page and reviewing exclusions with an agent can prevent painful surprises later.

How Much Business Insurance Costs for Small Businesses

The cost depends on industry risk, location, revenue, payroll, number of employees, claims history, coverage limits, deductibles, and the specific work you do. A low-risk consultant with no employees may pay much less than a contractor with a crew and vehicles. In general, businesses that involve physical labor, public interaction, or high-value property exposure tend to pay more.

The best way to think about cost is as a percentage of risk, not just a bill. You’re not buying insurance because you expect a claim; you’re buying it because you cannot afford the claim. A business that has the right coverage can survive incidents that would bankrupt an uninsured competitor. The premium is the predictable cost you accept to avoid unpredictable catastrophe.

How to Choose the Right Coverage: A Practical Approach

Start by identifying your exposures. Where do people interact with your business? What physical property do you rely on? What would happen if you had to stop operations for two weeks? Do you handle customer data? Do you have employees? Do you drive for work? Your answers point directly to the policies that matter most. A service business that goes on-site often needs general liability and potentially commercial auto or hired/non-owned auto. A professional services business may need E&O and cyber. A retail store may need a BOP with property and business interruption.

Then, choose limits based on worst-case scenarios, not average scenarios. If you damage a client’s property, how expensive could that be? If someone is injured, what are the potential medical and legal costs? If you’re unsure, ask for examples from your agent and consider adding an umbrella policy if the base limits feel too low for realistic risks.

Certificates of Insurance and Contract Requirements

Many small businesses encounter business insurance for the first time because a client asks for a Certificate of Insurance (COI). A COI is proof that you have coverage, showing policy types, limits, and effective dates. Larger clients may require specific minimum limits, additional insured status, or waivers of subrogation. These requirements are common in construction, commercial services, and B2B contracts.

This is why it helps to plan insurance early, not after you land the work. If you wait until a client demands it, you may scramble for coverage that meets their requirements, potentially at a higher cost or with delays. Having standard coverage in place allows you to accept better opportunities quickly and present yourself as a serious vendor.

Common Insurance Mistakes Small Business Owners Make

One of the most common mistakes is underinsuring—choosing the cheapest policy with limits too low or gaps that aren’t obvious. Another common mistake is not updating coverage as the business changes. If you add employees, buy equipment, start offering new services, or increase revenue significantly, your exposure changes and your coverage should be reviewed. A policy that was appropriate when you were solo can be dangerously inadequate when you grow.

Another costly mistake is assuming personal coverage applies to business activity—personal auto, homeowners, or renters insurance. In many cases, they exclude business use or offer only minimal protection. If your business relies on vehicles, home-based equipment, or client interactions, confirm what is covered and consider endorsements or separate business policies where needed.

How to Get Business Insurance: Online vs Agent vs Broker

Many small businesses can get basic coverage online quickly, especially general liability and professional liability. This can be a good route if your business is straightforward and low-risk. However, as complexity grows—employees, vehicles, property, higher limits, specialized services—an experienced agent or broker becomes valuable. They help you avoid gaps, meet contract requirements, and structure coverage for your specific risks.

The best approach is to get multiple quotes, compare not only price but also coverage details, and ask clear questions about exclusions and limits. Insurance isn’t the place where a tiny premium difference should override major coverage differences. Cheap insurance is only cheap until you need it.

Business Insurance as a Long-Term Business Strategy

Insurance isn’t just a defensive move—it can be an offensive advantage. Being properly insured makes your business more trustworthy, helps you win larger contracts, reduces financial volatility, and supports long-term planning. It also reinforces a mindset shift: you’re not just doing gigs, you’re building an enterprise that can survive uncertainty.

When you view insurance as part of your overall risk strategy—alongside safety procedures, contracts, documentation, cybersecurity hygiene, and quality control—you build a business that is harder to kill. That is what true stability looks like: not avoiding risk entirely, but being prepared for it without being destroyed by it.

Joshua Lee Bryant

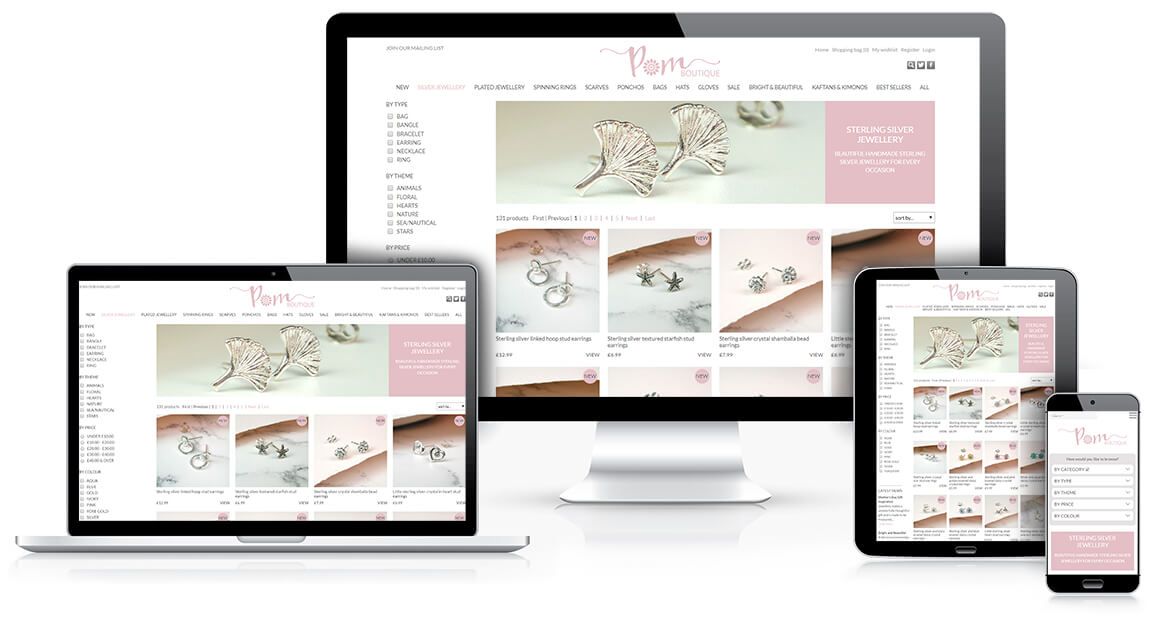

Advertising | Coaching | Web Design

Powerful, strategy-driven solutions for small to large businesses ready to gain more customers and grow.

Let's Grow Your Business | Coaching

Behind every thriving business is a strong strategy—and a trusted advisor. My consulting services offer expert insight, personalized guidance, and a collaborative approach that puts your goals first. Whether you're just starting or scaling up, I’ll help you move forward with clarity and confidence.

Your next step is just one conversation away.

Business growth doesn’t happen by chance, it happens when your offer, pricing, messaging, and customer acquisition system all work together. We’ll identify what’s holding you back, build a clear and realistic strategy, and then connect it to execution across the platforms that drive results.

You need to be able to trust that the person helping your business is properly qualified to do the job, as your budget, brand, and growth are at stake. I’m a business major, author, and experienced mentor who has helped 200+ businesses and taught small business development workshops through organizations like the SBDC, People Inc, and the YWCA. Backed by formal education (MSML and a BSBA in Marketing) with my doctorate in progress, advanced training in business strategy and entrepreneurship, and certifications in marketing and sales frameworks, I bring both strategic depth and real-world execution to every engagement, so your growth plan is built on skill, not guesswork.

Free Consultation

Ready To Accelerate Your Business To New Heights? I'm here to help. Fill out this form and I will promptly reach out to you for a Free Consultation!