Free Compound Interest Calculator

See how your savings and investment account balances can grow with the magic of compound interest.

Compound Interest Calculator

How to Use the Compound Interest Calculator

The Compound Interest Calculator is designed to help you estimate the growth of your savings or investment over time, considering the effect of compound interest. Follow this guide to make the most of this tool and project your financial growth accurately.

1. Enter Your Initial Deposit

- What is it? This is the starting amount you plan to invest or save.

- How to use:

- Input the total dollar amount of your initial deposit into the "Initial Deposit $" field. For example, if you're starting with $1,000, type

1000.

2. Set Your Contribution Amount

- What is it? This represents the regular contributions (deposits) you plan to make to your account over time.

- How to use:

- Enter the dollar amount you will contribute in the "Contribution Amount $" field. For example, if you plan to contribute $100 every month, type

100.

3. Choose Your Contribution Frequency

- What is it? This specifies how often you plan to make contributions (e.g., daily, weekly, monthly, or annually).

- How to use:

- Select from the dropdown menu under "Contribution Frequency" the interval that best represents how often you will contribute to the account:

- Daily: You will make contributions every day.

- Weekly: You will make contributions every week.

- Monthly: You will make contributions every month.

- Annually: You will make contributions once a year.

4. Set the Number of Years of Growth

- What is it? This is the total period over which your savings or investment will grow.

- How to use:

- Enter the number of years you plan to let your investment grow in the "Years of Growth" field. For example, if you plan to invest for 10 years, type

10.

5. Enter the Estimated Rate of Return

- What is it? This is the annual interest rate or rate of return you expect to earn on your investment. It is usually expressed as a percentage.

- How to use:

- Input the expected rate of return in the "Estimated Rate of Return %" field. For example, if you expect a 5% return per year, type

5.

6. Choose the Compound Frequency

- What is it? This defines how often interest is calculated and added to your balance (compounded). The more frequently interest is compounded, the greater the effect of compounding on your total balance.

- How to use:

- Select the desired compound frequency from the dropdown menu under "Compound Frequency":

- Daily: Interest is compounded every day.

- Weekly: Interest is compounded every week.

- Monthly: Interest is compounded every month.

- Annually: Interest is compounded once a year.

7. Click the "Calculate" Button

- What happens next? Once you've filled in all the fields, click the Calculate button. The calculator will process your input and generate a detailed graph and summary of your investment growth, including:

- Total Balance: The final amount in your account after the investment period.

- Total Investment: The total amount you have contributed over time.

- Total Interest: The total interest earned on your investment.

8. Review the Results

- What you’ll see:

- Graph: The bar chart will display the projected balance for each year of growth. Each bar represents a year, and the height of the bar corresponds to the balance for that year. The numerical balance for each year will also be shown above each bar.

- Summary: The "Total Balance," "Total Investment," and "Total Interest" will be displayed in bold text below the chart.

9. Download the Graph

- How to save your results:

- If you'd like to save a copy of your results, click the Download button. This will allow you to download the graph as a PNG image, including your calculated total balance, total investment, and total interest.

Understanding Compound Interest

Compound interest is a powerful way to grow your investments or savings. Here’s how it works:

- Initial Deposit: Your starting balance earns interest.

- Compounding: The interest is added to your balance at regular intervals (daily, monthly, etc.), so future interest is calculated on a larger balance each time.

- Contributions: Regular contributions increase your balance, and each contribution also earns interest over time.

The longer you allow your investment to grow, and the more frequently interest is compounded, the larger your total balance will be by the end of the investment period.

Tips for Using the Calculator Effectively

- Experiment with Different Scenarios: Try entering different rates of return, contribution amounts, or compounding frequencies to see how they impact your total balance over time.

- Use Realistic Rate of Return: Be sure to use a reasonable rate of return for your investment type. For example, stock market investments typically yield higher returns but come with more risk, while savings accounts offer lower returns with more stability.

- Longer Time Periods Show Greater Impact: Compound interest has a more dramatic effect over long time periods. The calculator can help you see how much your investment can grow if you let it compound for many years.

Conclusion

- With this Compound Interest Calculator, you can easily project how your savings or investment will grow over time. By inputting key financial details like your initial deposit, contribution amount, and rate of return, you can visualize the power of compounding interest and make informed decisions about your financial future.

Joshua Lee Bryant

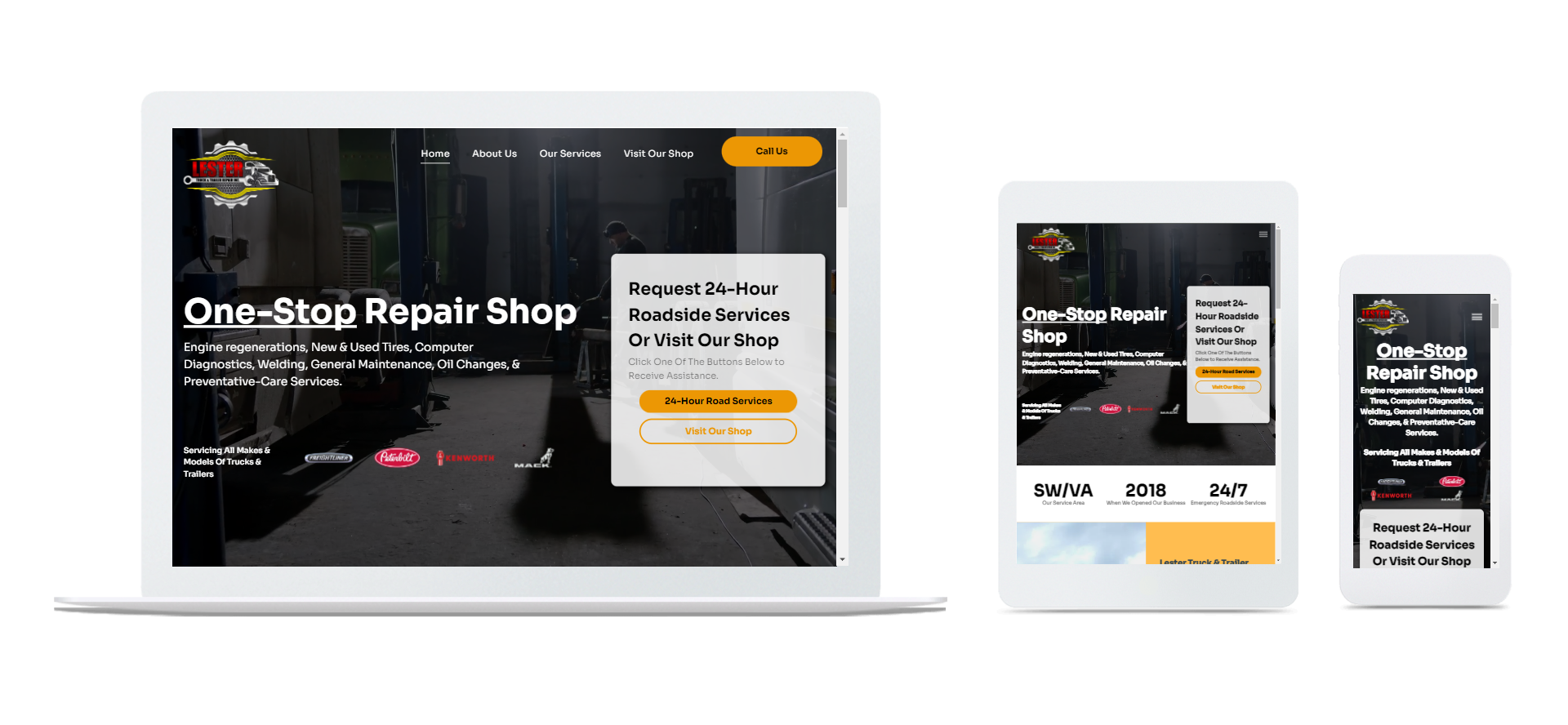

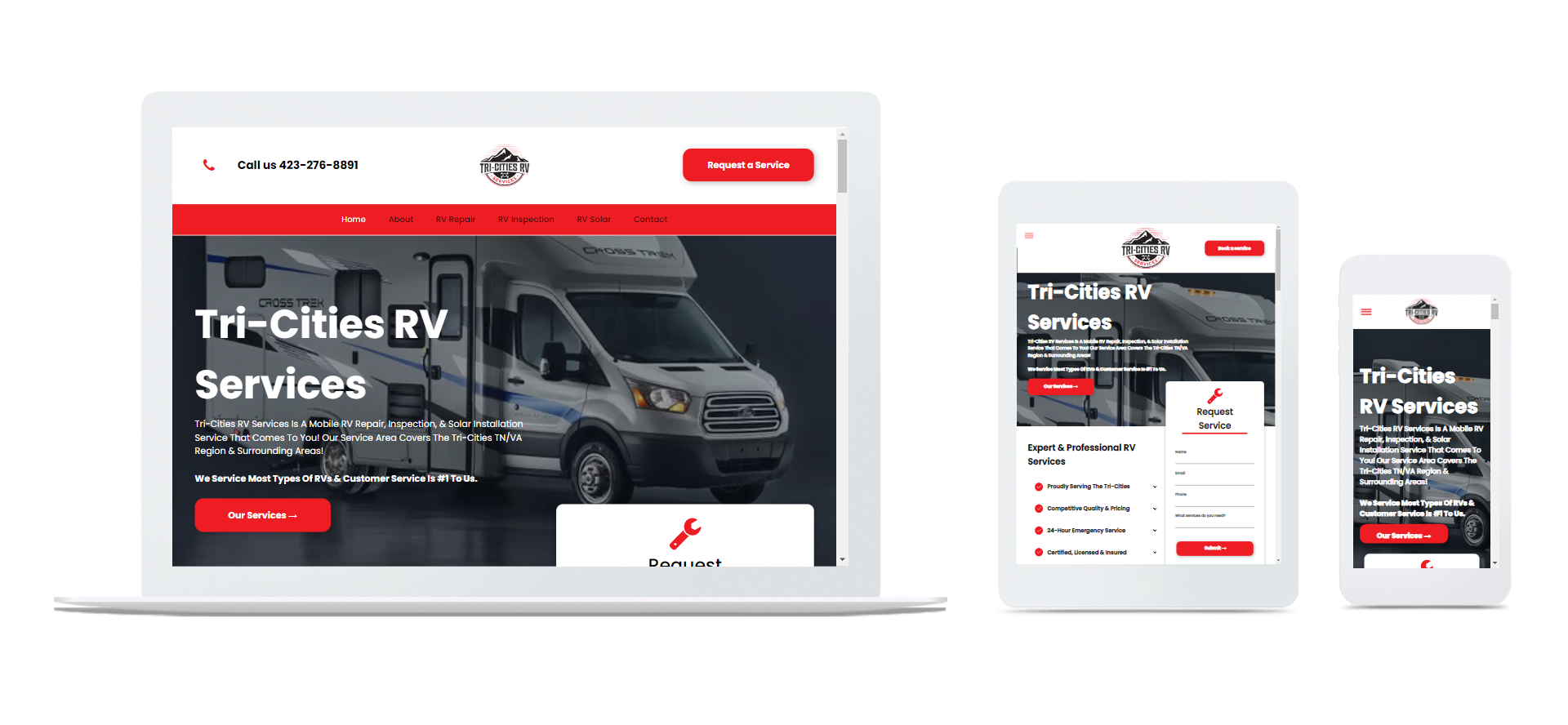

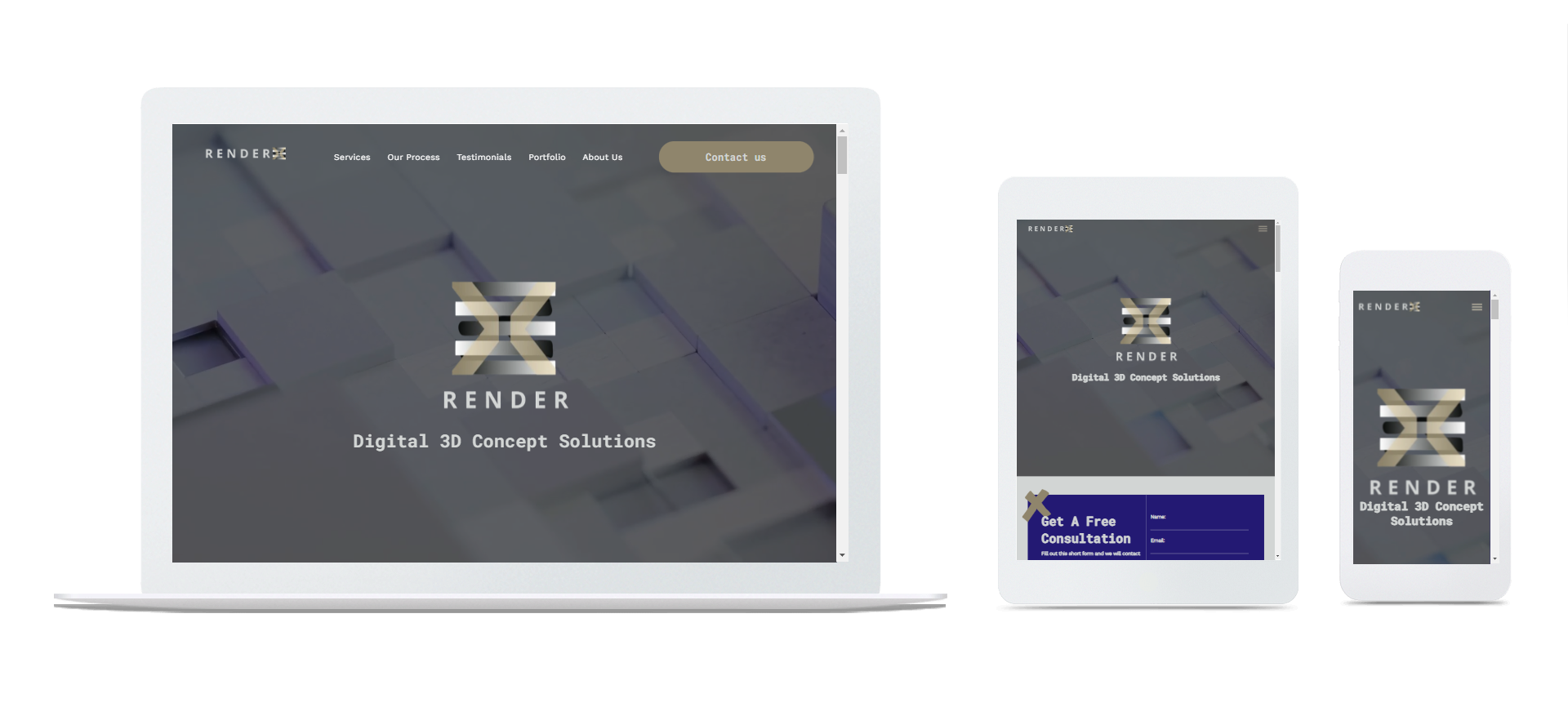

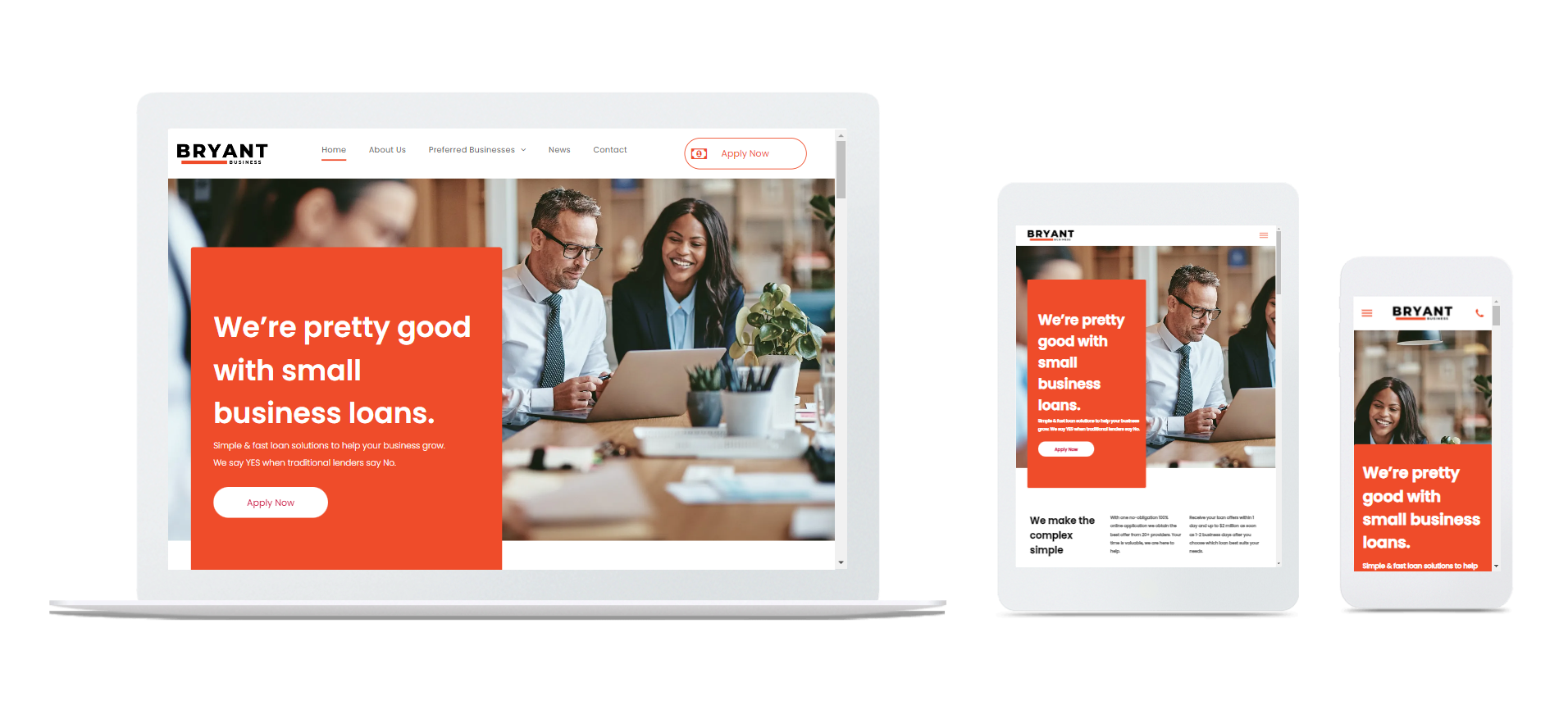

Marketing | SEO | Web Design

Affordable All-In-One Solutions For Small-Large Businesses Looking To Grow.

Let's Grow Your Business | Side by Side

Behind every thriving business is a strong strategy—and a trusted advisor. My consulting services offer expert insight, personalized guidance, and a collaborative approach that puts your goals first. Whether you're just starting or scaling up, I’ll help you move forward with clarity and confidence.

Your next step is just one conversation away.

Client Work: Backyard Environments

Case Study - Marketing Portfolio

A data-backed case study from a client that I was able to generate $1.4 Million Dollars in profit for during the 3-4 month time period of working together.

Common Questions

Frequently Asked Questions (FAQs) About My Services

How Can I Help You?

Ready To Accelerate Your Business To New Heights? I'm here to help. Fill out this form and I will promptly reach out to you for a Free Consultation!